The Euro, the Drachma, & the drama

Greece is set to redefine its place in the European economy this Sunday as it prepares to vote on a fairly confusing and short notice referendum.

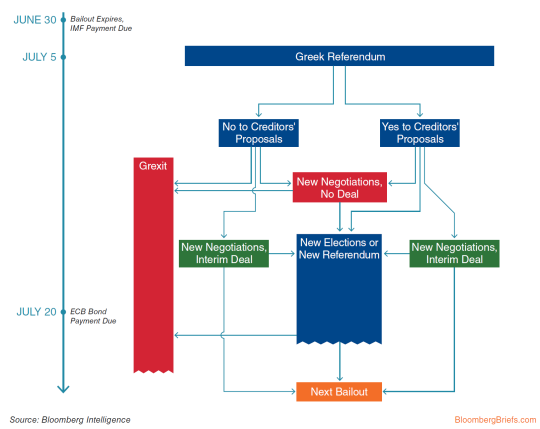

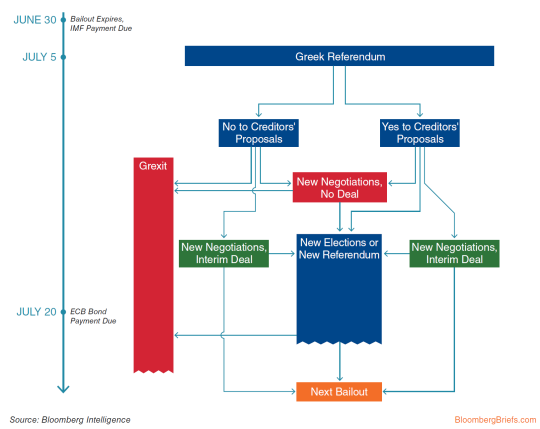

After months of attempted negotiations between the Greek government and its creditors regarding access to the last of it’s intended bailout money, PM Alexis Tsipras called for a referendum to let the citizens decide. The vote will determine whether the country will submit to austerity measures proposed by Greece’s creditors or not. Essentially a vote on keeping the Euro as currency, or going back to their old currency, the drachma and no longer being a part of the European Union. Greece, in short, is sinking fast and running out of options.

As Canadians, we are quite familiar with referendums and know the daunting nature of a nation’s future being decided in a quick yes or no vote. And with over $350 billion dollars owed to foreign investors (whether the European Union, Germany or the International Monetary Fund), it will no doubt be a while before Greece finds a working resolution.

Even if the end vote is a “No,” it does not necessarily mean that there will be a “Grexit” where Greece will leave the Eurozone in order to lighten up the financial burden it’s created. It also does not mean it will not be able to negotiate future austerity measures, as the current government was voted in based on their anti-austerity platform.

Greece is entering unknown territory that is worrying countries around the world. How will this affect the rest of us?

Will the global economy collapse again like it did in 2008? On a more in depth level, how will this affect international trade? How will this affect fashion? What about luxury fashion? The business of happiness is a worldwide trade that can be disrupted very easily.

Companies will surely be left with imbalances between different countries, meaning they will have to make adjustments to their European pricing, or their overseas pricing.

With Greek citizens only being allowed to withdraw €60 a day and banks on the verge of closing, it’s easy to tell their priorities will not be on luxurious goods. But for the rest of the world, those desires will still be sought after.

“You don’t go and buy your can of coke in Germany because it costs less there than it does in pounds, but if you’re prepared to buy €3,000 of bags from Chanel, you can think to spend a weekend shopping in Paris,” – Mario Ortelli, Luxury Good Analyst, explains.

The rest of the world will be watching closely as Greece tries to come to a resolution on Sunday.

Read more about fashion & the debt crisis here.

Greece is set to redefine its place in the European economy this Sunday as it prepares to vote on a fairly confusing and short notice referendum.

After months of attempted negotiations between the Greek government and its creditors regarding access to the last of it’s intended bailout money, PM Alexis Tsipras called for a referendum to let the citizens decide. The vote will determine whether the country will submit to austerity measures proposed by Greece’s creditors or not. Essentially a vote on keeping the Euro as currency, or going back to their old currency, the drachma and no longer being a part of the European Union. Greece, in short, is sinking fast and running out of options.

As Canadians, we are quite familiar with referendums and know the daunting nature of a nation's future being decided in a quick yes or no vote. And with over $350 billion dollars owed to foreign investors (whether the European Union, Germany or the International Monetary Fund), it will no doubt be a while before Greece finds a working resolution.

Even if the end vote is a “No,” it does not necessarily mean that there will be a “Grexit” where Greece will leave the Eurozone in order to lighten up the financial burden it’s created. It also does not mean it will not be able to negotiate future austerity measures, as the current government was voted in based on their anti-austerity platform.

Greece is entering unknown territory that is worrying countries around the world. How will this affect the rest of us?

Will the global economy collapse again like it did in 2008? On a more in depth level, how will this affect international trade? How will this affect fashion? What about luxury fashion? The business of happiness is a worldwide trade that can be disrupted very easily.

Companies will surely be left with imbalances between different countries, meaning they will have to make adjustments to their European pricing, or their overseas pricing.

With Greek citizens only being allowed to withdraw €60 a day and banks on the verge of closing, it’s easy to tell their priorities will not be on luxurious goods. But for the rest of the world, those desires will still be sought after.

“You don’t go and buy your can of coke in Germany because it costs less there than it does in pounds, but if you’re prepared to buy €3,000 of bags from Chanel, you can think to spend a weekend shopping in Paris,” - Mario Ortelli, Luxury Good Analyst, explains.

The rest of the world will be watching closely as Greece tries to come to a resolution on Sunday.

Read more about fashion & the debt crisis here.